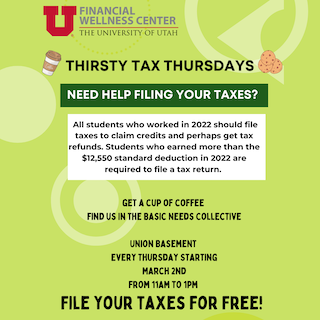

Free Tax Clinics for Students

All students who worked in 2022 should file taxes to claim credits and perhaps get tax refunds. Students who earned more than the $12,550 standard deduction in 2022 are required to file a tax return. That $12,550 includes earned income (from a job) and unearned income (such as from investments).

Whether or not you can be claimed as a dependent on your parents' tax return is based on your age, your student status, and who is paying the bills. Generally, a parent can claim you as a dependent until age 19, but if you are a full-time student, they can claim you as a dependent until age 24.

Come find us at the Basic Needs Collective in the Union Basement to file your taxes for FREE.